Let there be flow

“Prediction market” has always been a strange name to me, since prices in all kinds of markets are predictions. The price of a company’s stock is a reflection of an aggregate prediction about the net present value of its future cash flows, the price of an option comes from a prediction about the paths some underlying asset’s price might take, and so on. Further, if the strongest form of EMH is true, all knowable future event probabilities are already reflected in market prices. Byrne Hobart illustrates this well with the following image from his talk at Manifest 2022:

This looks like a pretty reasonable plot of P(Russia invades Ukraine) over time. Except that, as was subsequently revealed, the image is in fact an edited version of a screenshot of this Manifold question, wherein the original price graph has been replaced with that of front-month Brent crude futures1 over the same time period. As it turns out, the probability of a Russian invasion was one of the most important determinants of the value of oil, and given that oil futures are highly liquid, market participants are already incentivized to be good predictors of this event.

What makes prediction markets unique is not actually that their prices are predictions, but rather that their prices are predictions about just one event. When the price of crude moves, maybe it’s because P(Russia invades Ukraine) has changed, but maybe it’s because ships in the Red Sea are under attack or because Angola decided it wanted to leave OPEC. So if you sold crude as a way to bet against a Russian invasion, you also would have picked up all kinds of other unwelcome exposures. If you instead sold “Will Russia invade Ukrainian territory in 2022?” on a prediction market, you could be fairly confident that you now have exposure to exactly that event.

Precision is scary

The precision of such event contracts is a double-edged sword though. Proponents of prediction markets often present them as crystal balls that, if simply gazed into, reveal previously hidden probabilities to the world. And they’re not entirely wrong about that! But in order for price discovery to happen, there needs to be a reason for traders to trade. Traditional markets are astronomically more liquid than prediction markets for all kinds of reasons, but one major theoretical one is that there exists a massive amount of uninformed flow in traditional assets. This leads to more accurate prices: price-insensitive volume incentivizes liquidity provision, and in turn more liquidity incentivizes better price discovery.

To see an example of this chain from uninformed flow to better prices in the wild, consider the following:

- There are many entities in the world who have some natural exposure to oil prices. Airlines, who pay hundreds of billions of dollars annually for jet fuel, are a canonical example.

- It is therefore valuable for airlines to be able to lock in a price for their fuel, so that they no longer need to worry about fluctuations in price.

- This means that it is valuable for oil futures, contracts which settle to the price of oil at a specific time in the future and can therefore faciliate such “lock-in” transactions, to exist. Brent crude futures are a canonical example.

- An airline’s natural exposure is short oil, since the higher oil prices are, the more they need to pay for fuel. So one way that they hedge this exposure is by buying lots of oil futures.

- This order flow is uninformed! Billions of dollars trade, but not because the airlines all have some scary private information about the value of oil. They simply have a natural exposure, and it is valuable for them to get rid of it.

- Because this flow is uninformed and relatively price-insensitive, market participants are strongly incentivized to compete to provide to it, which increases liquidity and provides a competitive price to the airlines.

- Higher liquidity in turn incentivizes informed participants to trade2 since they can be rewarded in proportion to an increasing function of liquidity for correcting prices.

Such an enormous amount of uninformed order flow does a great job of incentivizing market participants to compete to provide liquidity, and almost as a side effect the market gets weirdly good at the task of understanding and predicting the fair value of oil, along with all factors that might affect it. Because the price of oil matters to so many real-world industries, airlines are just one of many entities with significant exposure to it. In other words, the lack of precision with which oil lets us bet on P(Russia invades Ukraine) is unfortunately not independent of its much higher liquidity.

Another way to see the same point is to consider prediction markets through the lens of the no-trade theorem, which roughly says that in a market with only rational participants and without any uninformed flow, no trades will occur. Every trade necessarily has a winner and a loser, and conditional on another rational participant accepting your trade proposal, it is likely you are the loser. In order for it to make sense for you to propose a trade, you need a reason to believe that even if someone else agrees to it, the trade is still good for you.

In the case of oil futures, it is relatively easy to justify: maybe your counterparty is an airline who is not so worried about losing out on some basis points, since the exchange in aggregate remains positive-sum. In a prediction market, it is relatively more difficult: maybe you are trading with someone who has natural exposure to a Russian invasion and is just looking for a hedge, but more likely your counterparty is, like, a guy who speaks Russian and is in dozens of Telegram groups waiting for just the right moment to trade against your resting order.

Super(conductors x forecasters)

You could imagine uninformed order flow growing in prediction markets over time via a similar mechanism to that of oil futures, even if the naturally exposed audience tends to be smaller. It is my understadning that every contract listed by Kalshi, a CFTC-regulated event contracts exchange, needs to have hedging utility. As I write this, Kalshi is in a legal dispute for the right to list contracts on US elections. It is no secret that sophisticated market participants already bet directly or indirectly on elections using other products, so a victory there might unlock natural hedging flow. Regardless of the mechanism, though, if you think accurate prediction markets prices are valuable, you should welcome uninformed flow.

In the real world, people trade for all kinds of confusing-to-economists reasons. One of the more mainstream moments for prediction markets in 2023 came when a team from South Korea published a paper claiming a material known as LK-99 exhibited room-temperature superconductivity. If you asked pretty much anyone with the relevant expertise, they would tell you that the team must have made a mistake and that the results were unlikely to replicate. Here is a screenshot of “Will the LK-99 room temp, ambient pressure superconductivity pre-print replicate before 2025?” on Manifold from the relevant time period:

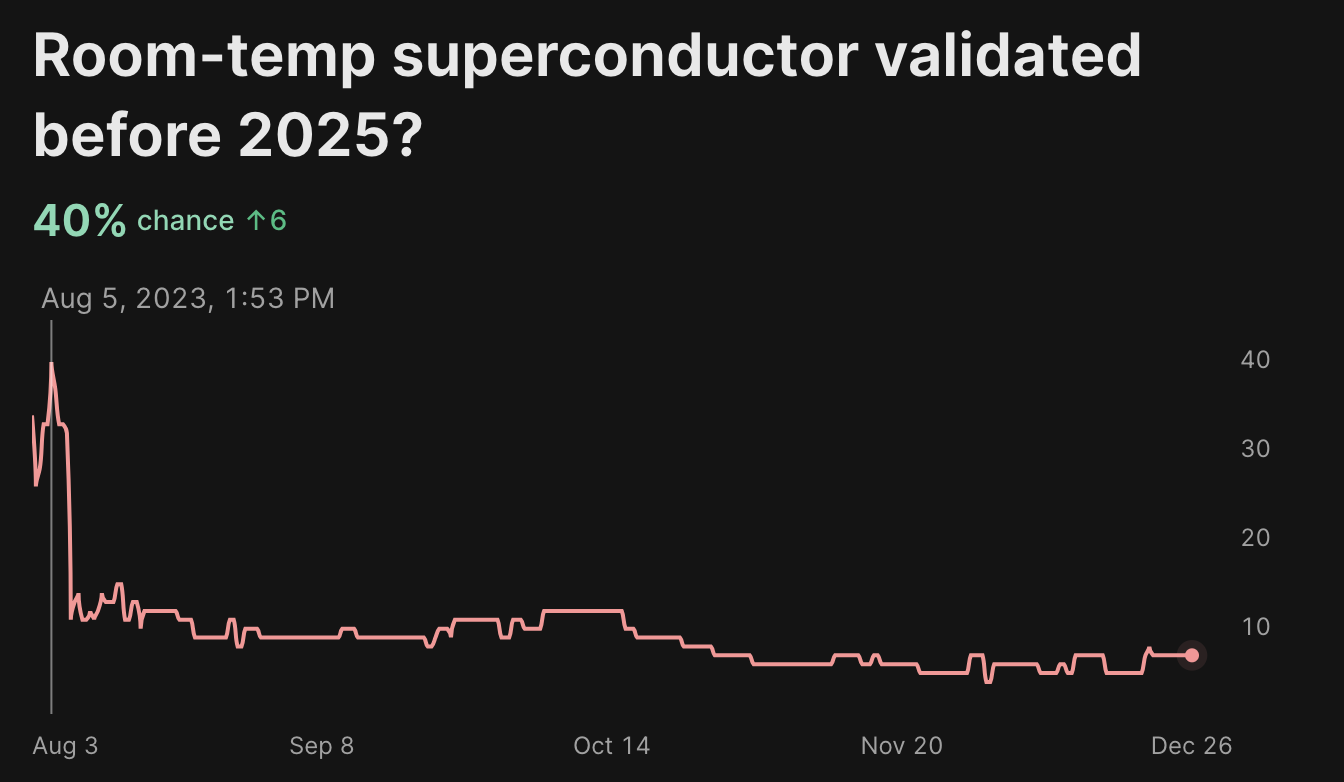

It is worth noting that Manifold uses play money and so maybe it is not quite a fair example. Here is Kalshi’s analogous market3:

And, just by the way, American Superconductor Corporation stock (NASDAQ: AMSC) was up 60% on August 1st.

I do want to note that I think there tends to be strong hindsight bias at play in these discussions: since LK-99 seems to have turned out not to be a room-temperature superconductor, it’s easy to write off relatively high probabilities as completely unreasonable. Perhaps on the margin they were more reasonable than we are now led to believe.

But it seems like there is more than one kind of uninformed flow. Erik Hoel does a thorough analysis of what happened here in “LK-99 as a cautionary tale for prediction markets”, which I recommend reading. In particular, one can fairly reliably map price movements to viral LK-99 tweets. Erik was not the only one to come to conclusions like the following:

I’m aware, of course, that the near tautological power of markets can always be appealed to. If prediction markets were too speculative and too virality-based, then wouldn’t experts stand to make a killing in the prediction markets by betting against such things? Perhaps. For experts are drops in the bucket, and prediction markets can stay irrational much longer than a small number of experts can stay solvent.

…

Having now seen prediction markets in action on LK-99, I think they are good at acting as de-facto very fast public polls (of the very online), but I’m worried that they don’t have much actionable soothsaying information above-and-beyond reflecting enthusiasm, and it’s unclear to me (a) how to avoid this, and also (b) what they would even look like at scale, other than similar to crypto, but potentially worse.

If anything though, the implications that lead from uninformed flow to more accurate prices should be especially strong for prediction markets. Comparisons to cryptocurrency hype at first glance seem reasonable, but there is an important difference: event contracts eventually settle to reality. Whatever it means for Bitcoin to be irrational, it is sort of allowed to be that for as long as it wants. Prediction markets can only “stay irrational” until the event either happens or it doesn’t, so the appeal to the “near tautological power of markets” is actually a good one. To the extent that you think 50% was a crazy probability, it should actually make you marginally more optimistic about the future of prediction markets; look at all that free money they are willing to helpfully award for someone to tell the truth!

The actual bad outcome for prediction markets is not that they are inundated with eager-to-trade but extremely-online-and-less-than-perfectly-informed participants, but rather that no one wants to trade them at all. Even when it leads to short-term price distortion, more uninformed flow is simply better for “actionable soothsaying information” in the long run. The precision that makes them so theoretically useful is itself a curse for their liquidity, so prediction market evangelists should welcome all new traders with open arms. If the superconductor posters keep it up, they might just subsidize the arrival of futarchy.